Social Security System is offering varieties of services for its active members. One of their services is cash loans

How much they can loan?

The member’s cash loans can be paid for 24 months installment. Payment will start in the second month upon approval of your application. All payments should be made before the deadline based on SSS 2011-03. The interest if you cash loans is 10% per year and the excess payment will be added to the principal amount. For members who failed to pay their payment on time will have a penalty and will be charged to their accounts. The SSS has a service fee at 1% and it will be deducted as loan proceeds.

Here are the steps for applying for a salary loan:

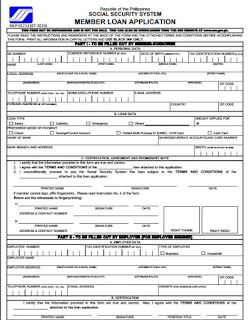

– fill up the Member Loan Application Form (you can get this in SSS offices or you can download the form in SSS site).

– Present your SSS ID

– 2 valid IDs

– wait for the application to be processed.

Who can apply?

If you cannot go personally to the SSS office, you can have someone to apply for your cash loan. This person must have authorization from you. And they also needed to bring the following:

– Members Loan Application Form of the borrower

– Social Security System ID and 2 valid IDs with signature and photos of the borrower

– 2 valid IDs of the authorized representative with photos and signature

– Authorization Letter sign by the borrower member and also signed by the authorized representative

If the cash loan application will be filed by the employer’s representative they need to bring the following:

– Member Loan Application Form by the borrower

– Present the SSS card of an authorized representative of the company

– Authorization Letter from the Employer

– 2 valid IDs of the representative with photos and signature

– acknowledgement stub

You can file your loan application in the SSS office in your country or you can file the application in the Philippines SSS Office.

Reminders:

All documents from abroad should be authenticated by the authorized representative of the Embassy.